If you use a tobacco surcharge on health insurance, properly Implementing it with a reasonable alternative standard is critical—not just for employees but for your organization as well.

Below are essential details about how to properly implement a tobacco surcharges and pitfalls to avoid from active legal developments.

Tobacco surcharge rules by state

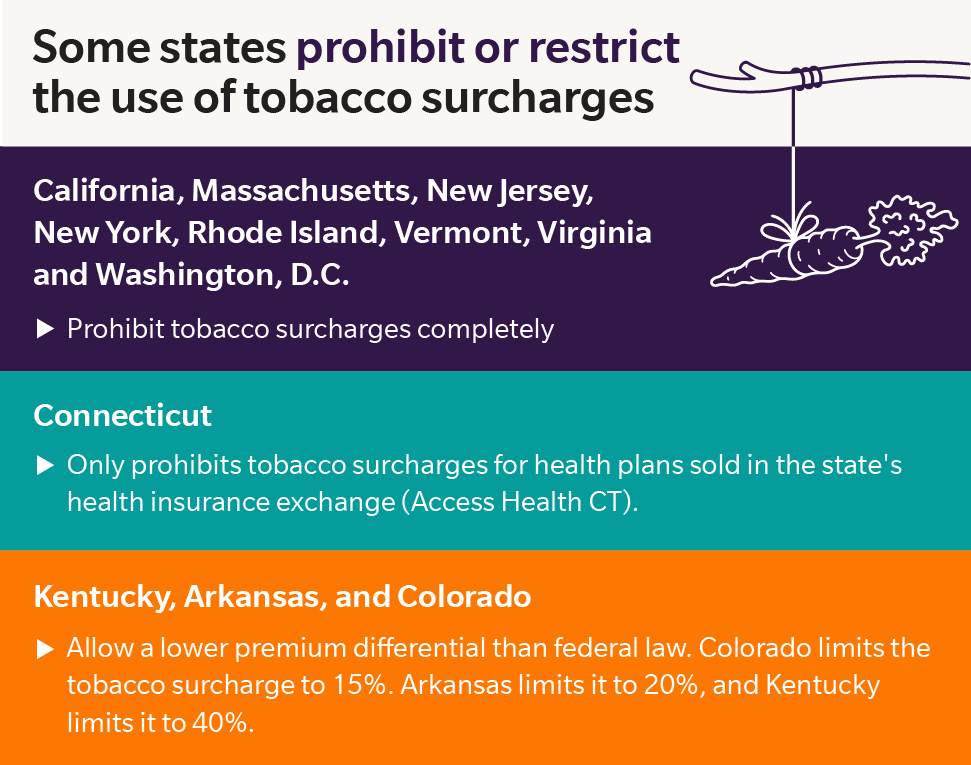

Even though federal law permits a tobacco surcharge on health insurance, some states prohibit this.

States that prohibit tobacco surcharges completely are California, Massachusetts, New Jersey, New York, Rhode Island, Vermont and Washington, D.C. Connecticut also prohibits tobacco surcharges, but only for health plans sold in the state’s health insurance exchange (Access Health CT).

In 2023, the State of Virginia also passed a law that prohibits health plans in the individual and small group health insurance market from imposing tobacco surcharges on health insurance premiums. This new law took effect Jan. 1, 2024.

Other states like Kentucky, Arkansas, and Colorado allow a lower premium differential than federal law. Colorado limits the tobacco surcharge to 15%. Arkansas limits it to 20%, and Kentucky limits it to 40%.

Most states, however, follow the federal law and allow insurers to impose tobacco surcharges of up to 50% but employer wellness programs must follow certain rules for those surcharges to be legal.

5-factor test to legally charge a higher premium with a tobacco surcharge

Employees are hiring attorneys who are familiar with the wellness incentive rules under the Employee Retirement and Income Security Act (ERISA) and are challenging employer wellness programs that are allegedly not in full compliance.

To qualify and be in full compliance with the ERISA wellness incentive rules, wellness programs that impose a tobacco surcharge on employees who use tobacco must pass a 5-factor test. See details about the 5-factor test in my blog post, What Is a Tobacco Surcharge and How Does My Company Offer One?

The EX Program qualifies as a reasonable alternative standard and has helped nearly 1 million tobacco users build the skills and confidence for a successful quit. To learn more, visit our Employers page.

Case #1: Secretary of Labor v. Macy’s, Inc.

Since 2011, Macy’s had imposed a $35 to $45/month surcharge on employees who were enrolled in the company medical plan and who had used tobacco products or had participating dependents who had used tobacco products within the last consecutive 6 months.

The United States Department of Labor (DOL) alleged that Macy’s tobacco cessation program violated the ERISA wellness program incentive rules for numerous reasons. In plan years 2011 and 2012, the program failed to offer employees a reasonable alternative standard and notice of that reasonable alternative standard.

Macy’s offered a tobacco cessation program to employees, but the only way to avoid the surcharge was for the employee to declare that all covered members in his or her family remained tobacco free for a period of six consecutive months during the health plan year.

During plan year 2013, Macy’s included a notice within the Tobacco Affidavit alerting the employee to the availability of a reasonable alternative standard, so it satisfied the notice requirement. But Macy’s tobacco affidavit also said, “I understand that the tobacco surcharge will not be changed retroactively, and no refunds or credits will be issued.”

In August 2017, the DOL, which enforces compliance with ERISA, sued Macy’s, Inc. as well as its third-party administrators for its self-insured health plan: Anthem Blue Cross Life and Health Insurance Company and Cigna.

The DOL alleged that this refusal to refund or credit participants for the tobacco surcharge even if they met a reasonable alternative standard violated the ERISA requirement that the full reward be made available.

In November 2021, the Ohio District Court ruled that the DOL’s case could move forward with the alleged tobacco surcharge violations for plan years 2011-2013. However, in February 2022, the Ohio District Court rejected the DOL’s motion and upheld that Macy’s did not violate its fiduciary duty under ERISA.

Even though the court ruled Macy’s did not violate its ERISA fiduciary duty by operating an illegal wellness program, the DOL was not without a remedy. The court pointed out that Macy’s still has a statutory and regulatory duty to operate a legal wellness program and that the DOL can still seek remedies for those violations, which are described below.

The DOL is asking the court for the following relief (in relation to the wellness program violations):

- to reimburse all participants who paid the tobacco surcharge from July 1, 2011, to the present (plus interest)

- to revise its wellness program to comply with ERISA wellness incentive rules, to prevent Macy’s from collecting tobacco surcharges until it revises tis wellness program to comply with the ERISA rules

- to empty all profits received as a result of its fiduciary breaches, and

- to pay the costs the government incurred to bring the lawsuit against Macy’s.

Case #2: Lipari-Williams v. Penn National Gaming, Inc.

Also in November 2021, a federal district court in Missouri certified a class action of 1500 casino workers who alleged, similar to the Macy’s case, that their employer violated ERISA with its tobacco surcharge.

Specifically, the employer, a casino, imposed a $50/month tobacco surcharge on health insurance on employees who used tobacco. The employer determined tobacco use status through an affidavit completed by each employee covered under the employer group health plan.

The plaintiffs in this case allege that the employer failed to notify employees of a reasonable alternative standard. Instead, the employer gave employees only two options:

- Don’t use tobacco and avoid the surcharge; or

- Use tobacco and be subject to the surcharge. In other words, according to the plaintiffs, the employer did not give them a reasonable alternative standard, like a tobacco cessation program, to avoid the $50/month surcharge.

In addition, the complaint alleges that even when the employer offered a reasonable alternative standard (i.e., a smoking cessation program), the employer did not provide employees the full reward once they completed the program.

Instead, the notice materials stated employees would only avoid the tobacco surcharge on a prospective basis. The plaintiffs state that the law requires the full reward be available upon completion of the reasonable alternative standard, which means the plaintiffs would be entitled to a refund of the $50/month penalty that they had already paid during that plan year.

The plaintiffs are seeking a refund of all the tobacco surcharges collected by the employer since 2016. Like the Macy’s case, this case is still pending.

Case #3: Secretary of Labor v. Flying Food Group

In September 2023, an Illinois federal judge entered an order requiring a Chicago-based food service provider for major airlines to reimburse its health plan participants $134,222 in part because of unlawful tobacco surcharges.

Flying Food Group violated federal wellness incentive laws when it “made plan participants pay a premium surcharge when they disclosed their tobacco use on health benefit enrollment forms.”

The company violated the ERISA wellness incentive rules by failing to provide notice to plan participants that a reasonable alternative existed that would allow them to avoid paying the surcharge. The company operated this illegal wellness program from January 1, 2011, to April 30, 2018.

What should workplace wellness programs do now?

Even though some of these cases are still pending, we can still draw lessons from these cases.

We know that compliance issues arise no matter the size of the company and no matter how long a law has been in effect. The ERISA wellness incentive laws have been in effect in their current form since 2013, which is a long time to get into compliance.

The lawsuits also teach us that wellness programs must not only offer a reasonable alternative standard but must make sure that anyone who completes that reasonable alternative standard qualifies for the entire reward for that plan year.

Providing adequate notice about the reasonable alternative standard is also mandatory. Now is a good time to review whether your wellness program is compliant with ERISA and other wellness program laws, including HIPAA, ADA, and GINA.

Finally, in light of the recent U.S. Supreme Court case Rutledge v. Pharmaceutical Care Management Association, which found that ERISA did not preempt a state law that limited pharmacy benefit manager (PBM) reimbursement rates, a question has arose regarding whether ERISA preempts state tobacco surcharge laws, such as the one recently passed by the State of Virginia.

Of course, until such a case with that specific issue is decided by the U.S. Supreme Court, we will not know for certain how the court would rule. However, there is a strong argument that ERISA would preempt state tobacco surcharge laws for self-insured employers.

For example, in Mebane v. GKN Driveline North America, Inc, a North Carolina federal district court found a large, presumably self-insured employer’s tobacco surcharge was governed by ERISA and not a state’s wage and hour law. In that case, the plaintiffs tried to argue that their employer’s tobacco surcharge deduction from their paychecks violated North Carolina’s law that requires paycheck deductions to obtain advance written notice before the wage reduction occurs.

The employer in that case argued that the tobacco surcharge was part of its wellness program, which was also part of its employee health plan, and that the tobacco surcharge was therefore subject to ERISA. Because ERISA preempts state laws that relate to an employee benefit plan, the employer argued that the plaintiffs’ claim about the tobacco surcharge should be dismissed. The North Carolina court agreed and dismissed the claim.

This case suggests that tobacco surcharges are not like state laws that limit PBM reimbursement rates, which the Supreme Court has decided states are free to regulate. States are likely not free to regulate tobacco surcharges across all health plan types. In the case of tobacco surcharges, federal law allowing such premium differentials should still apply, at least to self-funded group health plans.

For more information about legal considerations with tobacco surcharges, please connect with me at Center for Health and Wellness Law, LLC.

**Please Note: Nothing contained in this blog post is to be construed as legal advice. This blog post is for informational and educational purposes only. Readers are encouraged to seek legal counsel for any advice or compliance determinations needed on specific situations.**